What is happening with the economy after the extra powerful COVID stimulation? And why do the stocks suddenly go up, as if though there’s no pandemics? I will try to systemize my thoughts in a form of short notes.

Background

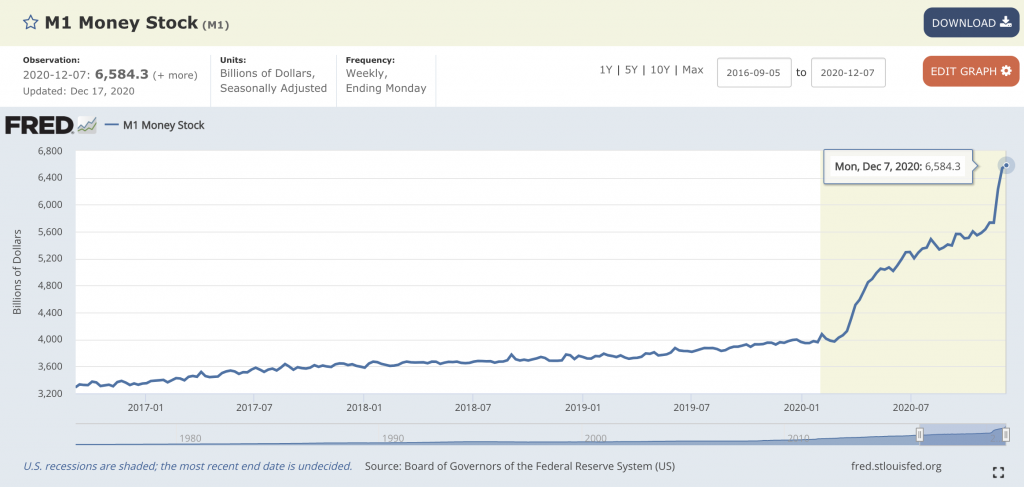

1. A lot of printing has been happening in the US to get out of COVID crisis.

2. The money have likely flown into the financial assets, real assets, foreign currencies and gold (they didn’t go to the banks equity: M3/M1 has fallen drastically and also Equity/Assets fallen for the banks).

3. Some industries are severely depressed (travel, hotel, airlines and other transport, retail, food)

What is happening now

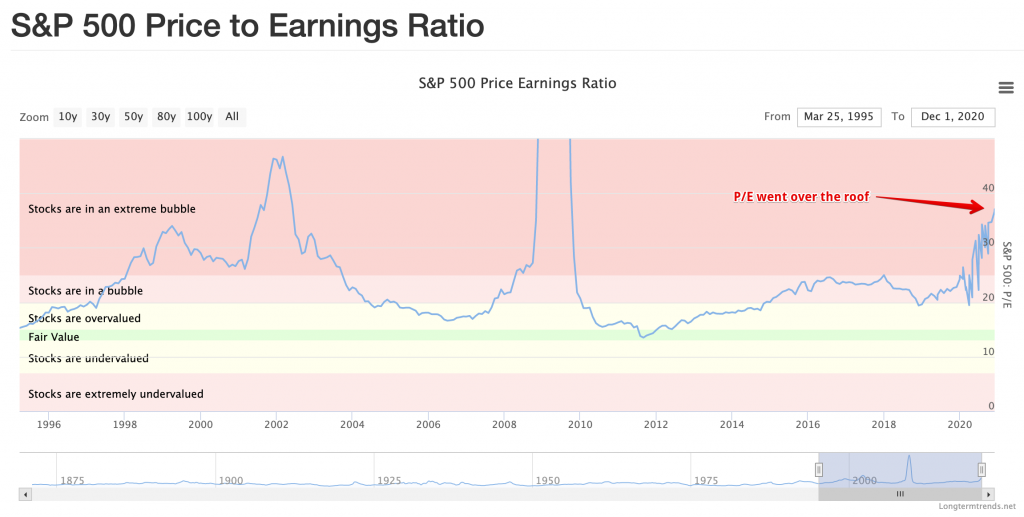

Stocks rise because of the printing, not because of the results (check P/E); also there is a self-reinforcing process: people invest because the stocks give great total returns, and they do so because people invest.

The P/E ratio confirms the stocks went up not because

the earnings improved (by and large they didn’t)

Remarkable indicators

| Consumer spending (falls) |

| PMI (still strong) |

| Consumer Durable Goods (still strong) |

| The banks decrease lending after an initial jump (early into corona) |

| Total biz sales (still strong) |

| Retailers’ – too |

| Car sales (depressed and fall) |

| Industrial capacity utilization (depressed) |

| Manuf real. output (low) |

| Delinquencies fell (weird; debt service relief? falling rates? financial stimulation?) |

| Banks: capital % of assets deteriorated |

So as you can see, the banks tighten lending, and also their capacity to lend (Assets/Eq) decreased. Consumer Spending & Sentiment still not good, but not falling. The corporate earnings are still mostly good, but car sales are depressed and fall.

- The economy feels not bad right now, but without the bank lending it will dry up

- The stocks soared because there’s not many options where to put the newly printed money in, but this is a bubble

The pressure on the dollar

- The COVID stimulation keeps unfolding (the announced QE takes place)

- People sell USD and purchase stock

- Trade Balance negative and keeps falling

- Current Account negative

- Gov Deficit highest in history

- Continued Unemployment highest in history (you can sustain those unemployed only by printing more)

- Net Capital Outflow (mild)

M1

Forecast (my investment thesis)

The dollar fundamentals will keep weakening, thus the USD will also lose value (against gold and r.e.) as more printing will be needed & the covid financial stimulation is still unfolding. The other currencies won’t necessarily appreciate against dollar (depends on what they do with their currencies). If the USD falls largely (say, 20%), it can become a self-feeding process as countries will look for alternative reserve currencies. Then it will fall another 20% or more.

The stocks keep rising and it’s a reflexive process (check Theory of Reflexivity by George Soros) – i.e. it feeds on itself until it’s unsustainable. What might trigger the downfall is a) unexpected event like COVID mutation or a correction of like 15%, b) deteriorating fundamentals (earnings). Then it will feed on itself in the opposite direction.

My positions

I’ll stay aside waiting for a critical event that might trigger the stock market crash or USD crash, then enter with a half-position to test my thesis.